[Authors note: This was a talk given at the International Conference entitled ‘Taking the Sri Lankan Peace Process Forward’ organised by the Observer Research Foundation in New Delhi on May 11, 2010.]

Introduction

For too long, the political processes in Sri Lanka to resolve minority grievances have been preoccupied with the nature of the state (unitary versus federal), unit of devolution of political and administrative power (village, district, or province), language, land, police, and other administrative issues. Very little discussions have taken place regarding the division of financial/fiscal powers between the centre and the peripheries. All the previous political processes have failed on one political and/or administrative issue or the other.

Even the externally imposed provincial council system under the Thirteenth Amendment to the Constitution has not lived up to the expectation of the minority communities because of the lack of devolution of land, law & order, and fiscal powers. Though land and law & order power devolution continues to be contested, the matter of fiscal devolution has not attracted the attention of the protagonists or the opponents of the Thirteenth Amendment thus far. So, this window of opportunity should be made use of to promote fiscal devolution as a stepping stone towards a durable political solution to the grievances of the minorities, particularly the Tamils of East and North.

Therefore, this paper would analyse the current fiscal architecture in Sri Lanka and propose a devolved fiscal set-up that could possibly be a stepping stone towards a durable political and economic solution to the enduring ethnic conflict in Sri Lanka.

Public Finance

Whilst the government revenue as a percentage of GDP was just 15%, government expenditure as a percentage of GDP was 25% in 2009. Therefore, the (national) budget deficit in 2009 was little over 10% of the GDP. Further, the total public debt as a share of the GDP was 86% in 2009 (Central Bank of Sri Lanka, Annual Report 2009, special statistical appendix tables 5&6). Moreover, the total government revenue is inadequate to meet the recurrent expenditures of the government (it has been the case since 1989) or the annual servicing of the public debt. In other words, part of the recurrent expenditure and the entire capital expenditure of the government and part of the public debt servicing are paid for by borrowed money.

In these precarious circumstances of the public finance, it is imperative to rationalise government expenditure and increase government revenue at the national, provincial, and local levels. The current government revenue as a proportion of the GDP in Sri Lanka (15%) is one of the lowest among the lower middle income countries. It has to be increased to at least 20%. Revenue mobilisation by the provincial and local governments is miniscule compared to the revenue mobilisation of the national government (see the following section); therein lies the potential to increase public revenue through fiscal devolution.

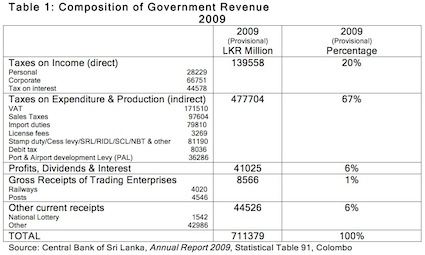

Two-thirds of the government revenue accrues from consumption (aka indirect) taxes and just 20% accrues from income (aka direct) taxes (see Table 1). Theoretically, consumption taxes are regressive and income taxes are progressive, because the rates of consumption taxes are equal to all who purchase goods and services irrespective of their income levels whereas the rates of income tax rise as the income of individuals or businesses rise (i.e. the amount of income tax is proportionate to the amount of income; higher the income, higher the income tax one pays – the principle of ‘ability to pay’).

Therefore, it is high time the government thinks out of the box to fix its fiscal deficit by transforming the nature, content and extent of the fiscal architecture of the national government vis-Ã -vis the provincial and local governments. The Presidential Tax Commission in deliberations during 2009-2010 could, hopefully, come up with some innovative ideas to narrow the gap between government revenue and expenditure and thereby practice fiscal prudence (in place of fiscal profligacy of the post-1977 period). If need be, amendments to the present Constitution should be made, for which the necessary parliamentary majority is within the grasp of the present government.

Provincial Finance

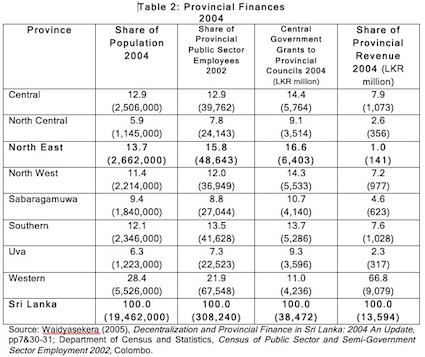

The total provincial revenue (from all eight provinces) has been between 3.5% (1999) and 4.3% (2004) of the total revenue of the national government during the 1999-2004 period. Whilst the total provincial revenue as a percentage of the national GDP has been constant at 0.6% during 1999-2004 period, the total revenue of the national government as a percentage of the GDP has consistently dropped from 17.7% in 1999 to 15.3% in 2004 (Waidyasekera, 2005: 4). On the other hand, the total provincial expenditure (by all eight provinces) has been between 10.2% (1999) and 11.7% (2003) of the total expenditure of the national government during the 1999-2004 period. In absolute amount, for example, while the total provincial expenditure in 2004 was LKR.57 billion, the total provincial revenue was LKR.14 billion in 2004 (Waidyasekera, 2005: 7&19).

Internationally, the sub-national government revenue as a percentage of the central government revenue has been high as circa 50% in Brazil (in 1998) and India (in 1999), moderate in Malaysia (15.4% in 1997) and Thailand (17.0% in 2002), and low in Indonesia (3.2% in 1993), Philippines (2.7% in 1993), and Sri Lanka (4.3% in 2004) (Waidyasekera, 2005: 5). The sub-national government expenditure as a percentage of the central government expenditure has been high as 88.7% in India (in 1999), moderate in Indonesia (13.7% in 1993), Malaysia (12.4% in 1997), and Sri Lanka (11.7% in 2003), and low in Philippines (5.5% in 1993) and Thailand (6.0% in 2002) (Waidyasekera, 2005: 20) The foregoing international comparison data is based on different years and therefore should be considered cautiously.

During the period 2000-2004, provincial revenue growth has been higher than the provincial GDP growth in all but the North East and Uva provinces (Waidyasekera, 2005: 12). For instance, the total revenue of the North East Provincial Council in 2004 (LKR.141 million) was only 0.08% of the Provincial GDP of the combined North East Province in 2004 (LKR.166,200 million) (Waidyasekera, 2005: 10).

Hence, the Provincial Councils in Sri Lanka depend heavily on transfers from the national government. For example, while the total provincial revenue from all eight provinces was LKR.13.6 billion, total transfers to all eight provinces by the national government amounted to LKR.38.5 billion in 2004 (see Table 2). The Finance Commission set up to assess the needs and disburse the financial transfers from the national government to the provincial governments has published only one Annual Report (2004) in the past twenty two years, which is an indication of the lacklustre in the implementation of the Thirteenth Amendment to the Constitution.

There is an argument that the second tier of government (i.e. provincial council system) is a costly exercise with overlapping of functions and very little benefits to the provinces (Hewavitharana, 1997)[1]. It is true that in 2009 the Ministry of Local Government and Provincial Councils (LKR.102 billion or USD.0.90 billion) was the fourth largest spending ministry after the Ministry of Finance (largely public debt repayment) (LKR.831 billion or USD.7.23 billion), Defence (including Public Security and Law & Order) (LKR.212 billion or USD.1.85 billion), and Public Administration and Home Affairs (LKR.106 billion or USD.0.93 billion).

However, it has to be noted that bulk of the expenditure of the Ministry of Local Government and Provincial Councils is for salaries and other consumption expenditures (76% in 2009) of the provincial public servants, who were transferred from the national public services to the provincial public services when the provincial councils were set up in 1988. Currently, out of the 1.3 million public servants (including semi-government employees), almost 300,000 are in the provincial services. Thus, only a small number of new recruitment was made directly to the provincial administrative services since 1988. Further, there were hardly any new buildings put up to house the provincial public administration in any province. Largely, existing public buildings were used by the provincial councils or were hired from private property owners.

Therefore, there was hardly any additional public expenditure incurred due to the setting up of the provincial councils. It was a mere transfer of public expenditure from the national to provincial level. In other words, suppose the provincial councils were to be abolished today, there would not be much savings on public expenditure because the provincial public servants have to be re-absorbed into the national public services.

Rationale for Fiscal Devolution

Fiscal decentralisation has gained momentum in capitalist and communist/socialist countries (such as China and Myanmar, for instance) and in unitary and federal states alike since the last quarter of the twentieth century. Country experiences have shown that fiscal decentralisation do enhance public goods and services delivery and poverty reduction (Ehtisham and Brosio, 2009). However, designing of fiscal decentralisation should be country-specific (Fedelino and Ter-Minassian, 2009). This author’s case for fiscal devolution is not based on the dichotomy of unitary versus federal constitutional cum political models, but stems from the evolving business model globally towards subcontracting and outsourcing the production line and the supply chain (Sarvananthan, 2009: 7). However, not everyone agrees that administrative, political and fiscal decentralisation is the panacea for economic efficiency (see, for e.g. Hewavitharana, 1997).

Public administration is most effective when it is closer to the people, which apply to tax administration as well. Closer the revenue authorities to the people higher the revenue collection. Therefore, the present Inland Revenue Department and Excise Department should be decentralised. Thus, provincial and local inland revenue and excise departments should be set up in order to collect direct and indirect taxes effectively at the lowest possible public administration unit. Information on local businesses and professions could be gathered more effectively by the local offices of the inland revenue and excise departments rather than by the centralised departments located in Colombo.

The devolved government revenue raising departments should have appropriate incentives and penalties for performance or lack thereof. That is, the national government should set annual target of revenue at each level of devolved units of revenue mobilisation. Incentive payments should be paid to those units that overshoot the target. Conversely, penalties should be imposed to those units that fall short of the target. By this way, the national government could incentivise the revenue collection at the provincial and local levels with rewards and penalties.

Financing the Post-War Reconstruction

Government’s avowed strategy for the economic revival of the conflict region is focused on physical (dwellings, roads, bridges, etc), economic (electricity, water, telecommunications, railways, etc), and social (schools, hospitals, etc) infrastructure development, which are indispensable. However, this author has serious reservations about the proposed financing of such infrastructure projects. Given the very tight fiscal space of the government as noted above, I do not think the government has adequate resources to finance such infrastructure development, because they are costly. Moreover, in the context of global financial crisis coupled with precarious external political relations of the present government, it is unlikely that the government will be able to mobilise adequate concessionary finance from external donors (both bilateral and multilateral). Infrastructure development is not a one-off capital expenditure. It has a recurrent expenditure in terms of the maintenance cost of such infrastructure for a long period of time.

In this scenario, the best option left for the government is to attract private capital (both domestic and overseas) for investment in infrastructure in the former conflict affected region and beyond under BOO (Build, Operate, and Own) or BOT (Build, Operate, and Transfer) modalities. The government’s attempt to re-build the rail line beyond Vavuniya up to Kankesanthurai (in the Jaffna peninsula) is laudable, because the northern rail line (legendary ‘Yarl Devi’) used to be the highest revenue earner for the erstwhile Ceylon Government Railways (CGR) prior to its termination in the mid-1980s as a result of the civil war. Besides, rail transport is cheaper than road, ocean or air transport due to lower fuel cost per passenger, and the absence of traffic congestion and security checkpoints.

However, I do not think the government has sufficient financial resources to spend on this ambitious but worthwhile project. The government is explicitly appealing to the people for contributions, and Sri Lanka’s diplomatic missions abroad are organising ‘benefit show’ to mobilise finance from the diaspora, which are highly unlikely to yield desired results. According to the Central Bank Annual Report (2008: 69), the Department of Railways incurred operating loss of Rs.12.5 million every single day during 2008 (annual loss was LKR 4,553 billion or approximately USD 43 million). Our suggestion is that, whilst the government could invest its own money as well as borrow from foreign donor/s to re-build the rail tracks and stations (infrastructure), it should open up the passenger transport to private capital (both domestic and foreign). That is, locomotives and rail cars/carriages could be invested, managed, and operated by the private sector. This kind of public-private partnership could be the best way to beat the fiscal crunch faced by the government. Although the national government could re-build the rail tracks and stations initially, the maintenance of the same should be handed-over to the respective provincial governments.

Similar public-private partnerships for infrastructure development in the former conflict affected areas could be explored amidst shrinking fiscal space at the national level.

Tax Reform Propositions

Presently, income tax collection is based on self-assessment made by the payee (either individual or corporate entity), which is not satisfactory. Instead income tax should be collected at source (PAYE – pay as you earn) as much as practically possible in order to improve compliance.

Tax reforms in Sri Lanka should be based on streamlining and reducing the number of direct and indirect taxes payable by individuals and corporations and rates of such taxes, and increasing the number of individual and corporate tax payers. That is, widening the tax base is the need of the hour, rather than deepening the number of taxes and their rates. Imposition of income tax on public sector employees and professionals is sine qua non for the widening of the tax base. Public sector employees in Sri Lanka are in an envious position, vis-Ã -vis most other countries, because their income is not subjected to PAYE tax. In India, for instance, the income of public sector employees (including armed forces personnel) is subjected to PAYE tax. Similarly, professionals such as doctors (who work privately as well in addition to their government job), lawyers, accountants, and teachers should be brought under the PAYE tax scheme.

The foregoing propositions could be best achieved under a devolved taxation system where tax avoidance and evasion could be minimised by being closer to the people. Bribery and corruption involved in tax evasion could also be minimised when the unit of surveillance is smaller and local.

In post-war Sri Lanka, the national government should abdicate most of its functions and responsibilities to all nine provinces and local authorities, except monetary currency, defence, and foreign affairs. The national government’s primary function should be regulator of the provincial and local governments under a unified country, such as imposing a cap on provincial budget deficit. In order to fulfil its functions and responsibilities, provincial and local governments should be given fiscal autonomy. That is, the provinces and local governments should be vested with the powers to raise and earn income and spend on public goods and services within the respective province and local authority (municipal, urban and village councils). Each province should impose and collect taxes, except import duty and excise duty and value added tax on imports. Hence, the national government’s revenue should primarily accrue from duties and taxes on international trade. Businesses within each province should register with and pay taxes (both direct and indirect) to their respective provincial government. Both the public and private sector employees within each province should pay income tax to their respective provincial government. At the same time, national government employees (such as the Central Bank staff, employees of the three armed forces, Ministry of Finance employees, and semi-government employees) should pay income tax to the national government. Appropriate mechanism could be devised to share the consumption (indirect) and income (direct) taxes earned by the provincial and local governments with the national government. As a corollary, public utilities such as electricity, water, road and rail transport, etc, should be regionalised.

By providing fiscal autonomy to the provincial and local governments, the national government could promote competition among provinces and local authorities to attract businesses and investments (both domestic and foreign). The fiscal space opened-up (or envisaged) for the provinces and local authorities by the aforementioned method would create an environment for productive competition among provincial and local governments. The national government should do away with the nanny state it currently operates, vis-Ã -vis the provinces and local authorities, by way of providing annual grants to the provinces and local authorities based on various criteria. Present financial transfers from the centre to the provinces are barely adequate to pay for salaries, pensions, and recurrent expenditures of the provinces. On the contrary, provinces should be encouraged to earn and spend their own money based on their priorities and decisions.

The foregoing propositions would require amendments to the present Constitution that could be incorporated in the upcoming overhaul of the Constitution by the present government. Alternatively, if there is no political or bureaucratic will to transfer fiscal powers to the provinces and local authorities, economic rationalism would suggest to abolish the second (provincial councils) and third (municipal, urban, and village councils) tiers of government despite the fact that the savings in public expenditure would be only small.

Conclusion

Although the Thirteenth Amendment to the current Constitution has vested some powers of revenue mobilisation to the provinces, it falls short of an effective and efficient mechanism to make the provinces financially viable and minimise their dependence on the national government. The tendency in the past twenty two years of the operation of the provincial councils (1988-2010) has been the monopolisation of taxation by the national government.

The political establishment of Sri Lanka and the psyche of the masses at present appear to be incapable of undertaking radical changes to the political and administrative architecture. Therefore, incremental devolution appears to be the pragmatic way forward for durable conflict resolution in Sri Lanka. Fiscal devolution, one such step in the incremental devolution process, could presumably attract stronger government and public support (than the devolution of political and administrative powers) under the present Unitarian government.

REFERENCES

- Central Bank of Sri Lanka, Annual Report 2009, Colombo.

- Department of Census and Statistics, Census of Public Sector and Semi-Government Sector Employment 2002, Colombo.

- Ehtisham, Ahmad and Giorgio Brosio, (eds), (2009), Does Decentralization Enhance Service Delivery and Poverty Reduction, Cheltenham (UK): Edward Elgar.

- Fedelino, Annalisa and Teresa Ter-Minassian, (2009), Macro Policy Lessons for a Sound Design of Fiscal Decentralization, July, Fiscal Affairs Department, Washington, DC: International Monetary Fund.

- Finance Commission, The, Annual Report 2004, Colombo.

- Hewavitharana, Buddhadasa, (1997), Economic Consequences of the Devolution Package and an Evaluation of Decentralisation, Colombo: Sinhala Weera Vidahana.

- Sarvananthan, Muttukrishna, (2009), “Economic Freedom: the Path to Economic and Political Emancipation of the Conflict-Affected Region in Sri Lanka”, PPID Working Paper Series, No.12, October, Point Pedro Institute of Development, Point Pedro.

- http://www.accord.org.za/downloads/ct/ct_2009_4.pdf

- Waidyasekera, D.D.M, (2005), Decentralization and Provincial Finance in Sri Lanka: 2004 – An Update, Research Studies: Governance Series No.8, November, Colombo: Institute of Policy Studies.

[1] Retired Prof. Hewavitharana is currently an economic adviser to the President and Chairperson of the Institute of Policy Studies (IPS) of Sri Lanka.

###

The author is the Principal Researcher, Point Pedro Institute of Development, Point Pedro, Northern Province, Sri Lanka. http://pointpedro.org corrections, comments and suggestions are welcome to [email protected].